Q: WHAT are the new rules that effecting Landlords now and over the coming years?

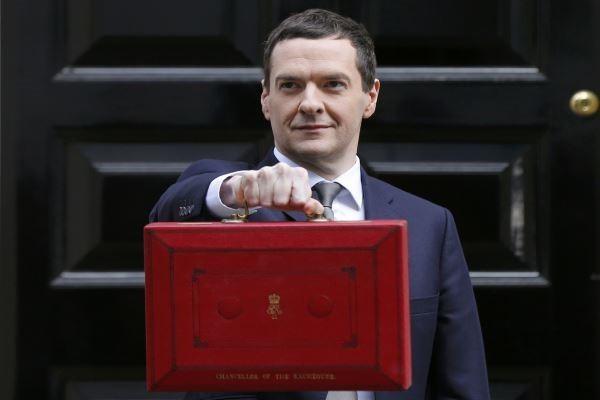

A: Some of the new changes that the chancellor George Osbourne introduced in the autumn statement have come into effect from April this year and some follow next year.

Over several articles I plan to detail these together with the implications for Landlords within the area.

In previous years Landlords have been able to claim as an allowable expense 10 per cent of their rental income for furnished accommodation to allow for the wear and tear of these items.

This figure was deductible irrespective of whether or not they actually incurred these costs.

The idea was that this would provide relief for the wear and tear and prevented you from claiming the whole cost of say a sofa that just happened not to last very long.

However this has now been replaced with a new system whereby one can only claim back the actual cost of the item which you have needed to replace.

Landlords who do their own tax returns (or your accountant, should you decide to outsource this to another party on your behalf) will be familiar with the process of claiming back relief on the expenses occurred in operating your investment business at your taxable income rate.

This is 20 per cent for the basic rate tax payer, though increases to 40 per cent and even 45 per cent for a higher rate tax payers.

This made investment property very tax efficient for the higher rate tax payers.

However this is about to change from April 2017 when there will be a phased reduction over four years to bring the rates down to the 20 per cent basic tax rate.

• 2017/18 – the deduction from property income will be restricted to 75 per cent of finance costs with the remaining 25 per cent available at the basic rate.

• 2018/19 – 50 per cent of finance costs available for full tax relief and the remaining 50 per cent available at the basic rate.

• 2019/20 – 25 per cent of finance costs available for full tax relief and the remaining 75 per cent available at the basic rate.

• 2020/21 – all financing costs incurred by a landlord will be given as basic rate tax reduction.

Within our catchment area, unless you have any student accommodation or provide furnished high end accommodation, typically found within the cities, then the wear and tear changes are unlikely to have much impact on properties let with the Stroud area.

However, the reduction in relief will affect those who some would argue are already privileged enough to be higher rate tax payers and should be able to weather the storm better.

Besides I am sure most basic rate taxpayers would consider the process of higher rate taxpayers able to claim back a higher proportion of expenses as somewhat unfair, so at least this now places all Landlords on a level playing field.

Albeit in four years’ time….

Please continue to send in your letting related questions to steven@sawyersestateagents.co.uk

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereComments are closed on this article